What's Hot: DC-Area Rents Fall Nearly 1% In November

4.39%: Mortgage Rates Hit 2011 Lows

4.39%: Mortgage Rates Hit 2011 Lows

✉️ Want to forward this article? Click here.

This morning, long-term mortgage rates dropped to a new low for 2011, as Freddie Mac reported that the average on a 30-year fixed-rate mortgage decreased to 4.39 percent with 0.8 of a point, down from 4.55 percent last week. The fall in rates was attributed to signs of a weakening economy.

The bad and the good from Freddi Mac vice president and chief economist Frank Nothaft:

“Treasury bond yields fell markedly after signs the economy was weaker than what markets had previously thought allowing fixed mortgage rates to follow this week. The economy grew 1.3 percent in the second quarter, which was below the market consensus forecast, and first quarter growth was cut to less than a quarter of what was originally reported. On a positive note, there were indications that the housing market is firming. Real residential fixed investments added growth to the economy in the second quarter after subtracting from growth over the first three months of the year. The CoreLogic® National House Price Index rose for the third straight month in June (not seasonally adjusted) and was the first three-month gain since June 2010.”

As UrbanTurf has said before, the rates reported by Freddie Mac for 30-year mortgages are usually the best rates that the most qualified borrowers can get. A July article in The Wall Street Journal goes into more detail about this.

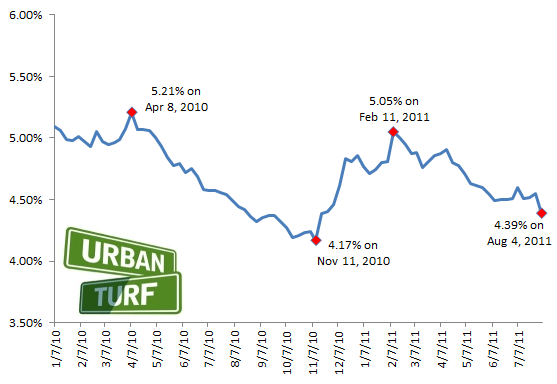

Here’s a look at the path of rates since last January:

See other articles related to: freddie mac, interest rates, mortgage rates

This article originally published at http://dc.urbanturf.production.logicbrush.com/articles/blog/4.39_mortgage_rates_hit_2011_lows/3920.

Most Popular... This Week • Last 30 Days • Ever

The 30,000 square-foot home along the Potomac River sold at auction on Thursday night... read »

With frigid weather hitting the region, these tips are important for homeowners to ke... read »

Today, UrbanTurf offers a brief explanation of what it means to lock in an interest r... read »

An application extending approval of Friendship Center, a 310-unit development along ... read »

A key approval could be coming for a proposal to convert a Georgetown office building... read »

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro