3.66: Rates Below 4 Percent For Three Straight Months

3.66: Rates Below 4 Percent For Three Straight Months

✉️ Want to forward this article? Click here.

Long-term mortgage rates were unchanged this morning, remaining at historic lows for the second week in a row.

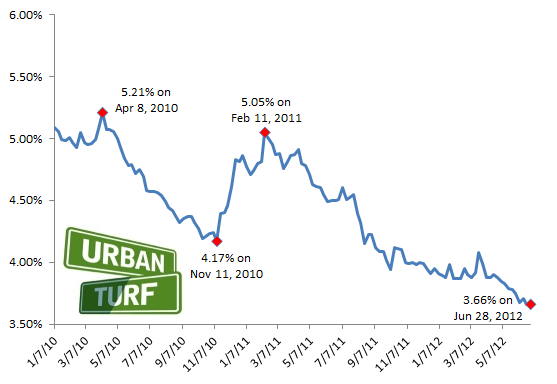

Freddie Mac reported 3.66 percent with an average 0.7 point as the average on a 30-year fixed mortgage. After a slight jump two weeks ago, rates had been dropping to record lows for six straight weeks. Thirty-year rates have now been below 4 percent for three straight months.

From Freddie Mac vice president and chief economist Frank Nothaft:

Mortgage rates were virtually unchanged this week hovering at or near record lows and should further help to support a recovering housing market. Both the S&P/Case Shiller® 20-city composite and the Federal Housing Finance Agency’s house price indexes showed over a 0.5 percent monthly increase in April. Meanwhile, pending existing home sales rebounded in May by 5.9 percent to match a two year high and new home sales jumped 7.6 percent to its fastest pace since April 2010.

The UrbanTurf Mortgage Rate Disclaimer: The rates reported by Freddie Mac for 30-year mortgages are usually the best rates that the most qualified borrowers can get, so borrowers or those considering refinancing should not necessarily read this news and think that they can go out and get a loan with the quoted interest rate.

Here’s a look at the path of rates since January 2010:

See other articles related to: freddie mac, interest rates, mortgage rates

This article originally published at http://dc.urbanturf.production.logicbrush.com/articles/blog/3.66_rates_below_four_for_three_months/5713.

Most Popular... This Week • Last 30 Days • Ever

While homeowners must typically appeal by April 1st, new owners can also appeal.... read »

A significant infill development is taking shape in Arlington, where Caruthers Proper... read »

A new mixed-use development would bring hundreds of new residential units and a healt... read »

A residential conversion in Brookland that will include reimagining a former bowling ... read »

After years of experimenting with its branded brick-and-mortar grocery concepts, Amaz... read »

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro