What's Hot: Just Above 6%: Mortgage Rates Drop To 2022 Lows | Facebook Co-founder Lists DC Home For Sale

3.55: Rates Finally Move Back Up

3.55: Rates Finally Move Back Up

✉️ Want to forward this article? Click here.

After falling to record lows for 13 of the past 14 weeks, rates finally moved back up this week.

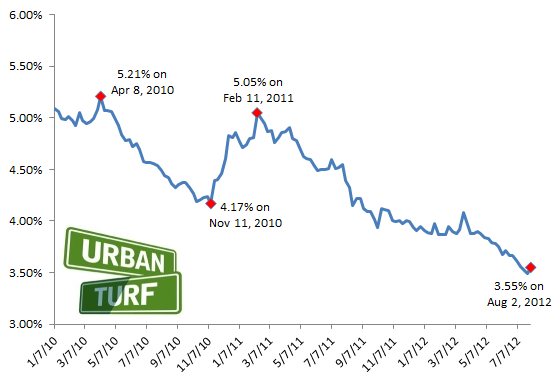

This morning, Freddie Mac reported 3.55 percent with an average 0.7 point as the average on a 30-year fixed mortgage. Last week, rates dropped below 3.5 for the first time, hitting 3.49 percent. With the exception of one week, rates have been below 4 percent for all of 2012.

From Freddie Mac vice president and chief economist Frank Nothaft:

Recent announcements of additional debt relief for the Eurozone and mixed domestic economic indicators added upward pressure on Treasury yields as well as mortgage rates this week. Housing data were also assorted. The S&P-500 Case Shiller® 20-City Composite Index rose for the fourth consecutive month in May with 18 of the cities experiencing positive growth. Nonetheless, pending home sales fell 1.4 percent in June, below the market consensus forecast of a 0.3 percent increase, and May’s figure had a downward revision.

The UrbanTurf Mortgage Rate Disclaimer: The rates reported by Freddie Mac for 30-year mortgages are usually the best rates that the most qualified borrowers can get, so borrowers or those considering refinancing should not necessarily read this news and think that they can go out and get a loan with the quoted interest rate.

Here’s a look at the path of rates since January 2010:

See other articles related to: mortgage rates

This article originally published at http://dc.urbanturf.production.logicbrush.com/articles/blog/3.55_rates_finally_move_back_up/5858.

Most Popular... This Week • Last 30 Days • Ever

Today, UrbanTurf is taking a look at the tax benefits associated with buying a home t... read »

Only a few large developments are still in the works along 14th Street, a corridor th... read »

On Thursday night, developer EYA outlined its plans at a community meeting for the 26... read »

Today, UrbanTurf is taking our annual look at the trajectory of home prices in the DC... read »

EYA and JM Zell Partners have plans for 184 townhomes and 336 apartments spread acros... read »

- A Look At The Tax Benefits of Buying a Home Through a Trust

- Church Street, U Street + Reeves: A Look At The 14th Street Development Pipeline

- A First Look At Friendship Commons, The Big Plans To Redevelop Former GEICO Headquarters

- The 10-Year Trajectory Of DC-Area Home Prices In 4 Charts

- 520 Residences Planned For Former GEICO Campus In Friendship Heights

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro