24 Percent of DC Homeowners Have Negative Equity

24 Percent of DC Homeowners Have Negative Equity

✉️ Want to forward this article? Click here.

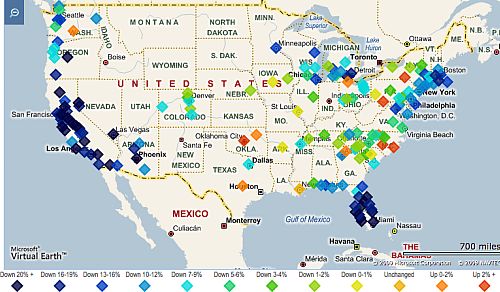

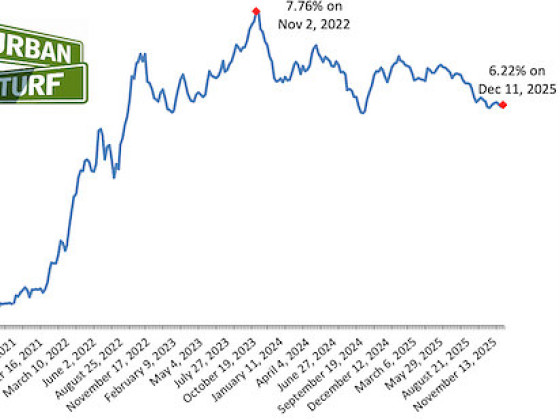

Zillow.com announced in a recently released report that one in five U.S. homeowners owes the bank more than their home is worth. The report also noted that 23.9 percent of homeowners in the DC area have negative equity.

The news of the large percentage of “underwater” borrowers was released just days after indications that dropping prices are making homes more affordable for first-time buyers. Despite that good news, it appears that homeowners who bought a property in the last couple years with a small down payment, have almost no equity in their homes.

Courtesy of Zillow

The Zillow Real Estate Market Report, which tracks 161 metropolitan statistical areas in the U.S., also showed that home values in the country dropped for the ninth consecutive quarter, declining 14.2 percent from a year ago, and falling 21.8 percent since the market peak in 2006.

For the full report, click here.

This article originally published at http://dc.urbanturf.production.logicbrush.com/articles/blog/24_percent_of_dc_homeowners_have_negative_equity/880.

Most Popular... This Week • Last 30 Days • Ever

With frigid weather hitting the region, these tips are important for homeowners to ke... read »

Today, UrbanTurf offers a brief explanation of what it means to lock in an interest r... read »

An application extending approval of Friendship Center, a 310-unit development along ... read »

The 30,000 square-foot home along the Potomac River sold at auction on Thursday night... read »

The number of neighborhoods in DC where the median home price hit or exceeded $1 mill... read »

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro